Getting Started with Estate Planning

Imagine your affairs are in good order. Your mortgage, insurance policies, pension and investments are well organised and easy to understand. But what if you were temporarily or permanently unable to make decisions? Who would know where your important documents are? Who could access your digital accounts, passwords or cryptocurrencies?

Many people do not yet have complete answers to questions like these. That is where Estate Planning helps.

👉 Related: Which Documents Are Essential for Your Estate Plan

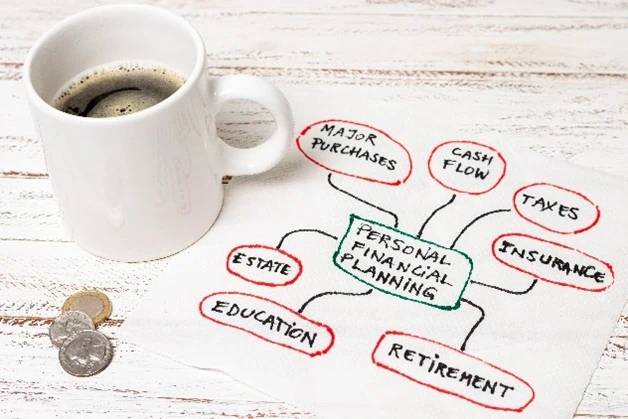

What Is Estate Planning?

Estate Planning is the deliberate and thoughtful arrangement of your assets and your legacy. It goes beyond tax and legal paperwork. It is about clarity, peace of mind, and certainty for you and for your loved ones.

By deciding now how your assets and digital possessions should be managed and passed on, you ensure everything reflects your values and wishes.

👉 Learn more: Your Digital Life: Chaotic or Organised?

Why Is It Important?

Rapid digitalisation, complex financial products, and unexpected events can make things unclear. Without a solid plan, families may face delays, surprises, and avoidable stress.

Estate Planning helps prevent this and keeps you in control of your life and your legacy. It is not only a financial or legal exercise. It is a practical way to make sure your intentions are carried out.

What Can You Do Yourself?

You can prepare a great deal before you involve an expert. Start by creating a clear overview of your:

Finances, including bank accounts and investments

Insurance policies

Mortgages

Pension arrangements

Digital assets such as online accounts, passwords, and cryptocurrencies

Think about practical access. Who can reach your social media profiles, devices, email, and cloud storage? Which documents will your family need, and where are they stored?

It is also important to record your wishes. Consider:

How you want your estate to be distributed

What should happen to heirlooms and digital assets

Whether you want to support a charity

Any specific instructions for dependants or executors

Writing this down makes any conversation with a specialist far more productive.

👉 Explore: Funeral wishes in Life After Me

How Can a Specialist Help?

An Estate Planner brings all these strands together in a tailored strategy. They look at your full financial and digital picture and align everything with your wishes. The more insight and documentation you prepare in advance, the more effective that discussion will be.

👉 Related: Legacy Planning for Entrepreneurs

The Role of Life After Me

Life After Me helps you securely store and manage important documents, passwords, insurance details, and your recorded wishes.

You can:

Share selected information with trusted people — your Buddies — so they know exactly what to do when needed

Designate your Estate Planner as an Expert Adviser, giving them permission to upload documents to your personal Life After Me account

The secure online platform helps you take control of your digital and financial legacy. It also makes it easier to start an informed conversation with an Estate Planner, so you arrive prepared and get more value from the advice you receive.

👉 Learn more: Our Security & Certifications

Start Today, For Now and For Later

Ready to take the first step with your Estate Planning today?

👉 Create your free trial account and start securing your legacy.